This week’s issue presented by Ridge Lending Group

What happened…

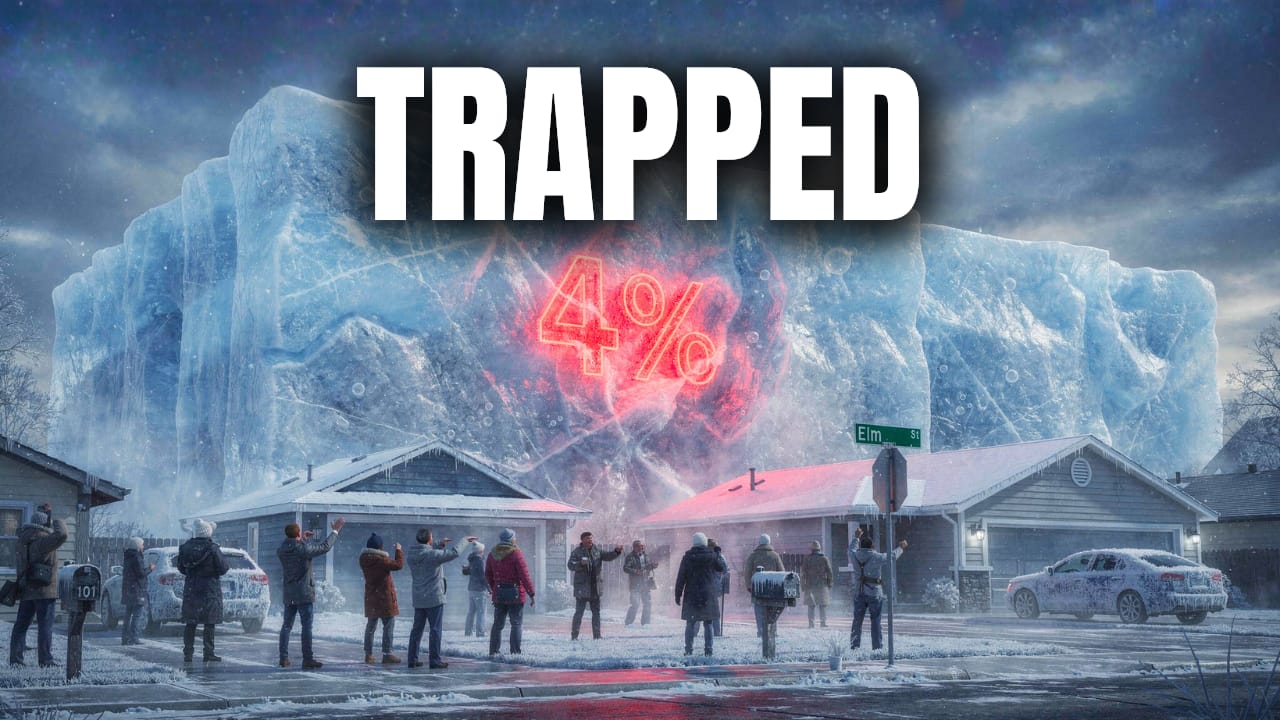

The 30-year fixed mortgage rate finally dipped to 6.18% this week, and the mainstream media threw a party. But actual homeowners aren't invited—because 54% of the market is sitting on a rate under 4% and refuses to sell. The "lock-in effect" isn't loosening; it’s hardening into a stalemate.

Takeaways…

54%. That is the massive chunk of US mortgages locked in at ≤4%. These owners are mathematically trapped.

The Math Gap. Swapping a 3% rate for today's 6.18% rate increases the monthly payment on the same house by roughly 40%.

The Standoff. Usually, lower rates bring more sellers to the market. This time, the rate is still too high to entice the "Golden Handcuff" crowd, keeping inventory dangerously thin.

Explain Like I’m 12…

Imagine you have a VIP Lunch Pass that lets youhey eat for $5. The Principal offers to swap it for a "New & Improved" pass that costs $10. You don't trade. You stay in the cafeteria and eat your cheap sandwich forever. That is the US housing market right now.

What this releases…

The Remodel Boom: If owners can't move up, they build out. Expect a surge in HELOCs and contractor demand as people upgrade the house they are stuck in.

The Shadow Inventory: The only homes hitting the market are the "Three Ds"—Death, Divorce, and Default. Voluntary moves are dead.

Why it matters…

Reality A (Buyers): Prices won't crash because supply won't spike. You are fighting over scraps.

Reality B (Owners): Your low-rate mortgage is an asset that pays you every month. You are being paid to sit still.

Backroom breakdown…

The Fed broke the housing ladder. By keeping rates near zero for a decade, they turned residential real estate into a "Hotel California"—you can check out any time you like, but you can never leave (without doubling your payment). They want transaction volume to return, but they can't get it without crashing the economy to force people to sell.

Real estate angle…

Stop looking for "move-up" sellers; they are extinct. The only liquidity in this market is distress. You need to target tired landlords and probate situations where the seller has to exit regardless of the rate.

Move or miss?

Ignore the MLS. The best deals are hidden behind those 3% mortgages. Use the NEW Deal Machine to identify the owners with high equity and high distress—that’s the only place the lock-in doesn't matter.

Lurking in the Shadows:

👟 The Consumer Just Blinked

Consumer confidence dropped to 89.1, crossing a critical level that the Wall Street Journal flags as a reliable recession signal. While the stock market parties, the people actually buying goods are terrified of tariffs and job losses.

💡 Why you should care: When confidence crashes, spending freezes—expect a wave of "distressed sellers" to hit the market in Q1 as household reserves run dry.

🟢 Smart Move: Distress creates bargains, but only for those with cash. Secure your access to 0% liquidity now so you have a war chest ready when the panic selling starts. Check your eligibility at FallbackFunds.com

👟 Office Towers Are Officially Toxic

Commercial real estate stress is flaring again, with office loan delinquencies hitting a new all-time high of 11.76%. The "Return to Office" mandates failed to save the landlords, and banks are now holding billions in underwater concrete.

💡 Why you should care: Commercial losses force banks to tighten lending everywhere; when the big towers fail, the credit window for residential investors slams shut.

👟 The Hidden Rent Hike Is Coming

Congress punted on healthcare subsidies, meaning average ACA premiums are projected to jump from $888 to $1,904 starting in January. Millions of households are about to lose an extra $1,000 of monthly purchasing power overnight.

💡 Why you should care: If your tenants are living paycheck-to-paycheck, that extra insurance cost is coming directly out of your rent check—watch for late payments in working-class neighborhoods.

On The Radar…

🏦 Shadow Banks Are Loading Up: Private credit firms quietly bought $136 Billion of consumer debt, signaling that traditional banks are dumping risk while Wall Street doubles down.

💰 Taxes Are The Forever Rent: Chicago homeowners saw bills spike as high as 133%, a reminder that the government is the only landlord you can never evict.

🟢 Don't just accept the bill—check if you are over-assessed instantly at FightMyAssessment.com.

🚘 The 8-Year Car Loan Is Here: Borrowers are signing 100-month contracts just to afford a $760 payment, destroying their debt-to-income ratio for a decade.

🫧 The Bubble Is 2% Away: The S&P is flirting with 7,000, but veterans call it a "classic bubble" where the exit door is much smaller than the entrance.

💵 Main Street Is Hoarding Cash: Business equipment borrowing dropped 4.4%, proving that while the stock market hypes growth, actual owners are cutting costs.

🏙 NYC Housing Is Broken: The city hit just 13% of its construction goal, guaranteeing that supply stays strangled and landlords keep the leverage.

🖇 The Connection

Thesis: The economy has shifted from a "Growth Engine" to a "Liquidity Trap," and the walls are closing in on the middle class.

The Receipts:

Look at the contradiction. The stock market is touching 7,000, yet Main Street businesses are cutting spending (Radar) and consumers are signing 8-year car loans just to keep a vehicle in the driveway (Radar). Meanwhile, 54% of homeowners are effectively prisoners of their own low rates (Top Signal), unable to sell even as healthcare premiums jump by $1,000/month (Shadows).

The Model:

Think of it like a pressure cooker with the lid welded shut. The heat (taxes, insurance, inflation) is turning up, but the steam (sales, mobility, spending) has nowhere to go. In a normal market, people sell assets to relieve pressure. Today, they literally cannot afford to sell because the cost of the next mortgage is double the one they have.

So What:

This creates a dangerous "Stasis." Home prices won't crash in a straight line because there is zero supply, but the standard of living inside those expensive homes is collapsing. For investors, the "Flip" game is on life support. You cannot bank on a quick exit in a frozen market. You must own assets that cash flow despite the pressure cooker, or you will get cooked alongside the consumer.

What to Watch Next:

Keep an eye on Private Credit (Radar). The smart money is quietly buying up billions in consumer debt because they know the American household has no choice but to pay the vigorish forever just to stay afloat.

#️Number of the Week

100

The number of months people are now financing cars just to afford the monthly payment.

The Takeaway: By the time they finally pay off the loan, the car will be old enough to vote.

🎯 The Hit List!

✅ Hunt It: 54% of owners are locked in at low rates (Story #1). Stop marketing to "move-up" sellers and focus exclusively on the Three Ds: Death, Divorce, and Default.

✅ Audit It: Healthcare premiums are jumping $1,000/month for some families (Story #4). Re-verify your tenant's income buffer before signing a long-term lease renewal.

✅ Fight It: Tax bills in cities like Chicago just doubled (Story #6). Never accept the assessor's first number—treat it like an opening bid and appeal immediately.

✅ Dodge It: Office delinquency hit a record 11.76% (Story #3). Unless you have infinite cash and patience, let the banks hold those heavy bags.

✅ Ignore It: The S&P 500 flirting with 7,000 is a liquidity illusion (Story #8). Don't confuse a stock market bubble with a healthy economy.

🚪 Closer

"A 3% mortgage is a financial fortress, but an 8-year car loan is a prison cell. Know the difference."